File GSTR-3B

In TallyPrime, you can export data in the JSON format and upload it to the portal for filing the returns.

Ensure that all exceptions regarding incomplete/mismatch in information are resolved before printing or exporting the GSTR-3B report. File GSTR-3B in either of the following methods:

- By generating the JSON file from TallyPrime

- By using the GSTR3B Excel Offline Utility Tool

- By filing your returns directly on the GST portal

Generate the JSON file from TallyPrime

- Gateway of Tally > Display > Statutory Reports > GST Reports > GSTR-3B.

Alternatively, press Alt+G (Go To) > type or search GSTR-3B > press Enter. - F2: Period – select the period for which returns need to be filed.

- Press Alt+E (Export) and select E-Return from the menu.

- Select JSON (Data Interchange) as the File Format.

- Enter the export location in the Folder path field.

- Retain the File Name of the GSTR-3B JSON file.

- Press Enter.

- Click Send to export.

Upload the JSON file to the portal for filing returns.

Submit and file GSTR-3B returns

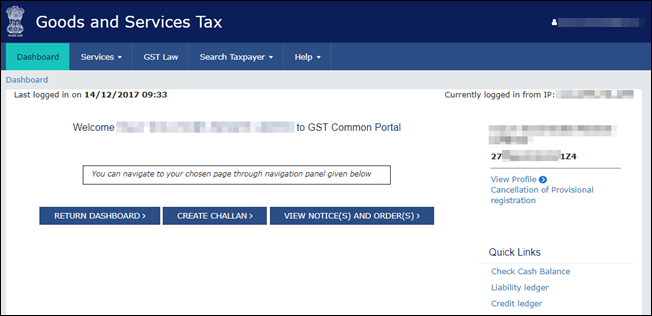

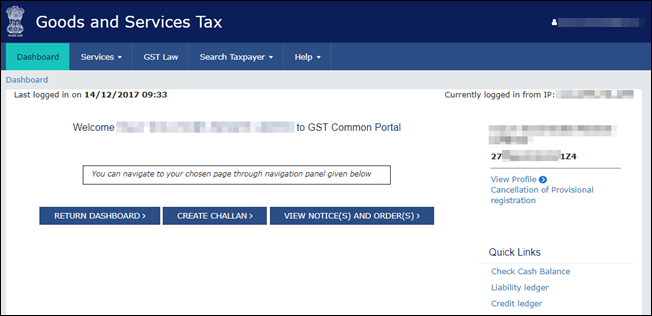

- Press Alt+V (Open GST Portal) from GSTR-3B report, to log in to the GST portal.

- Login using your credentials.

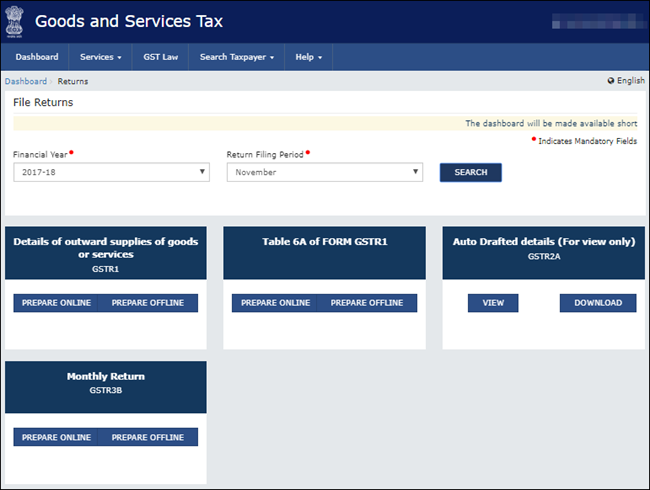

- Go to Dashboard > RETURN DASHBOARD.

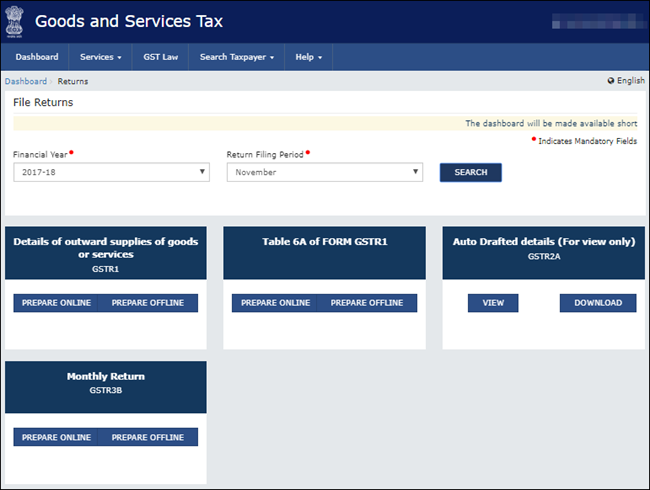

- Select the Return Filing Period, and click Search.

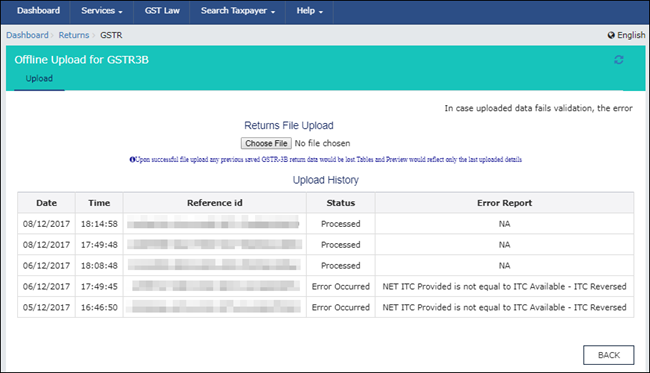

- Under Monthly Return GSTR3B, click PREPARE OFFLINE > UPLOAD tab > click CHOOSE FILE to import the GSTR-3B JSON file generated from TallyPrime. Once your JSON files are uploaded successfully, you will be notified with a message. Once the file is successfully uploaded the Error Report displays NA.

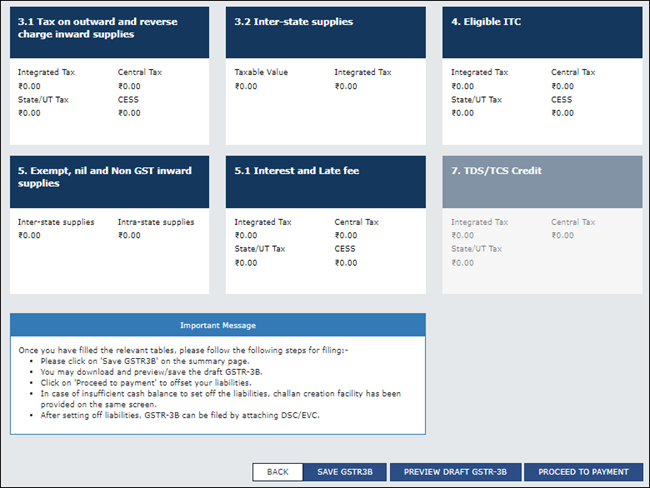

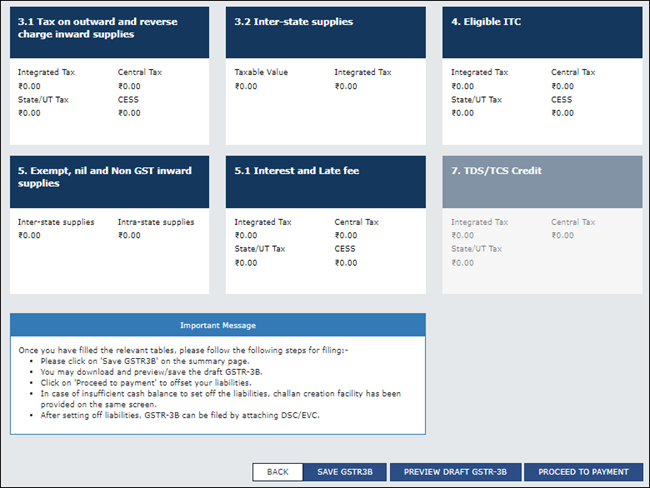

- Click BACK > Monthly Return GSTR3B, click PREPARE ONLINE. The values get posted in the relevant tables of GSTR-3B.

- Click SAVE GSTR3B to save the details.

- Click PREVIEW DRAFT GSTR-3B to preview or download the form, check the details, and correct it if required.

- Click PROCEED TO PAYMENT to view the available input tax credit. You can modify the values if required.

- Confirm the input tax credit, to offset against the payable value. For the balance amount payable, challan gets generated automatically with the relevant details, and payment options appear.

- Once you make the online payment, the payments table appears.

- Click PROCEED TO FILE, select the authorised signatory and SUBMIT with EVC or DSC.

Note: Once you click the SUBMIT button, GSTR-3B cannot be revised.

Use the GSTR3B Excel Offline Utility Tool

To download the tool

- Press Alt+V (Open GST Portal) from GSTR-3B report, to view the GST portal.

- Click Downloads > Offline Tools > GSTR3B Offline Utility.

- Click Download.

- Click PROCEED. A .zip file containing the GST Excel Utility is downloaded. Some important information about the tool, and the system requirements for using the tool are also available on the download page.

- Extract the file GSTR3B_Excel_Utility_V4.3.xlsm from the GSTR3B_Excel_Utility.zip file and copy it to the location where TallyPrime is installed.

Export GSTR-3B returns to the MS Excel template

Ensure to use a fresh template each time before exporting the GSTR-3B data.

- Gateway of Tally > Display > Statutory Reports > GST Reports > GSTR-3B.

Alternatively, press Alt+G (Go To) > type or search GSTR-3B > press Enter. - F2: Period – Select the period for which returns need to be filed.

- Press Alt+E (Export) and select E-Return from the menu.

- Select Excel (Spreadsheet) as the File Format.

- Enter the export location in the File path field. Ensure the file GSTR3B_Excel_Utility_V4.3.xlsm is available in the File path.

If the template GSTR3B_Excel_Utility_V4.3.xlsm is not available in the File path, the message appears as shown below:

- Copy the GSTR-3B template to the File path.

- Press Enter and click the Send button to export data to the template.

The Microsoft Excel template opens with the data updated in the relevant fields.

- In the template:

- Click Validate to view the status of the sheet.

- Click Generate File. The JSON file gets generated in the folder GSTR on the desktop.

- Upload this JSON file on the GST portal. Click here for the procedure of submitting and filing GSTR-3B.

Note: If the status is Validation Failed, correct the errors mentioned in the template, and then click Validate.

For more details on the information captured in each column of the e-return template, click here.

File your returns directly on the GST portal

Ensure the MS Word application is available in your computer to view the form.

- Gateway of Tally > Display > Statutory Reports > GST Reports > GSTR-3B.

Alternatively, press Alt+G (Go To) > type or search GSTR-3B > press Enter. - Press Alt+P (Print) and select Return Form form the menu.

If negative net values exist in any of the tables, the same will be printed as per the e-filing requirements. - In the Print Report screen, press Enter or click Print button. GSTR-3B is created in the word format.

- Press Ctrl+S to save the word file.

You can print the word file and use the hard copy to fill information online or directly copy and paste the values from the MS Word file to the online form.

File GSTR-3B

- Log in to the GST portal.

- Login using your credentials.

- Go to Dashboard > RETURN DASHBOARD.

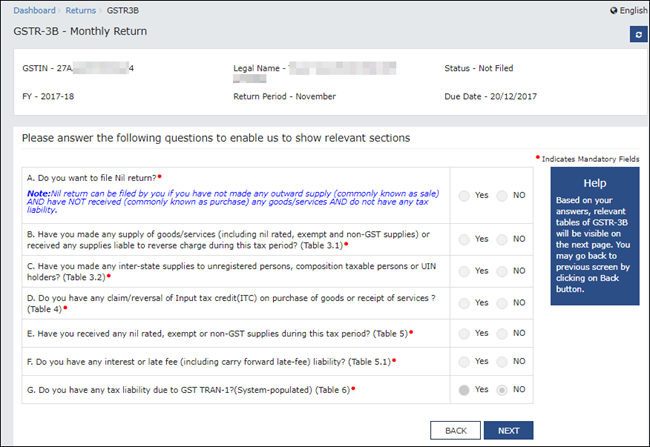

- Under Monthly Return GSTR-3B, click PREPARE ONLINE.

- Select the required options in the GSTR-3B dashboard to view the relevant sections of GSTR-3B in the next screen. Click NEXT to proceed.

- Click each table and manually fill the details by referring to the GSTR-3B printed from TallyPrime in the MS Word format. Click CONFIRM in each table after providing the details.

- Click SAVE GSTR3B to save the details.

- Click PREVIEW DRAFT GSTR-3B to preview or download the form, check the details, and correct it if required.

- Click PROCEED TO PAYMENT to view the available input tax credit. You can modify the values if required.

- Confirm the input tax credit, to offset against the payable value. For the balance amount payable, challan gets generated automatically with the relevant details, and you will view the payments option.

- Once you make the online payment, you will view the Payments Table.

- Click PROCEED TO FILE, select the authorised signatory and SUBMIT with EVC or DSC.

Note: Once you click the SUBMIT button, GSTR-3B cannot be revised.