Import of Services (Service Tax)

As per department rules, import of service is any service provided from outside India and received in India. The tax in such transactions is known as tax on import of services, and the service receiver is liable to pay service tax on availing such a service.

The service tax paid on imports cannot be considered for availing input credit. Rule 5 of section 66A states that the service tax liability created against the imported services cannot be treated as output services for the purpose of availing credit of tax or duty paid on inputs/input services. Further, the credit available cannot be used for payment of service tax liability created towards imports. However, in some cases assessee may be allowed to avail the input credit on the tax paid on imported services.

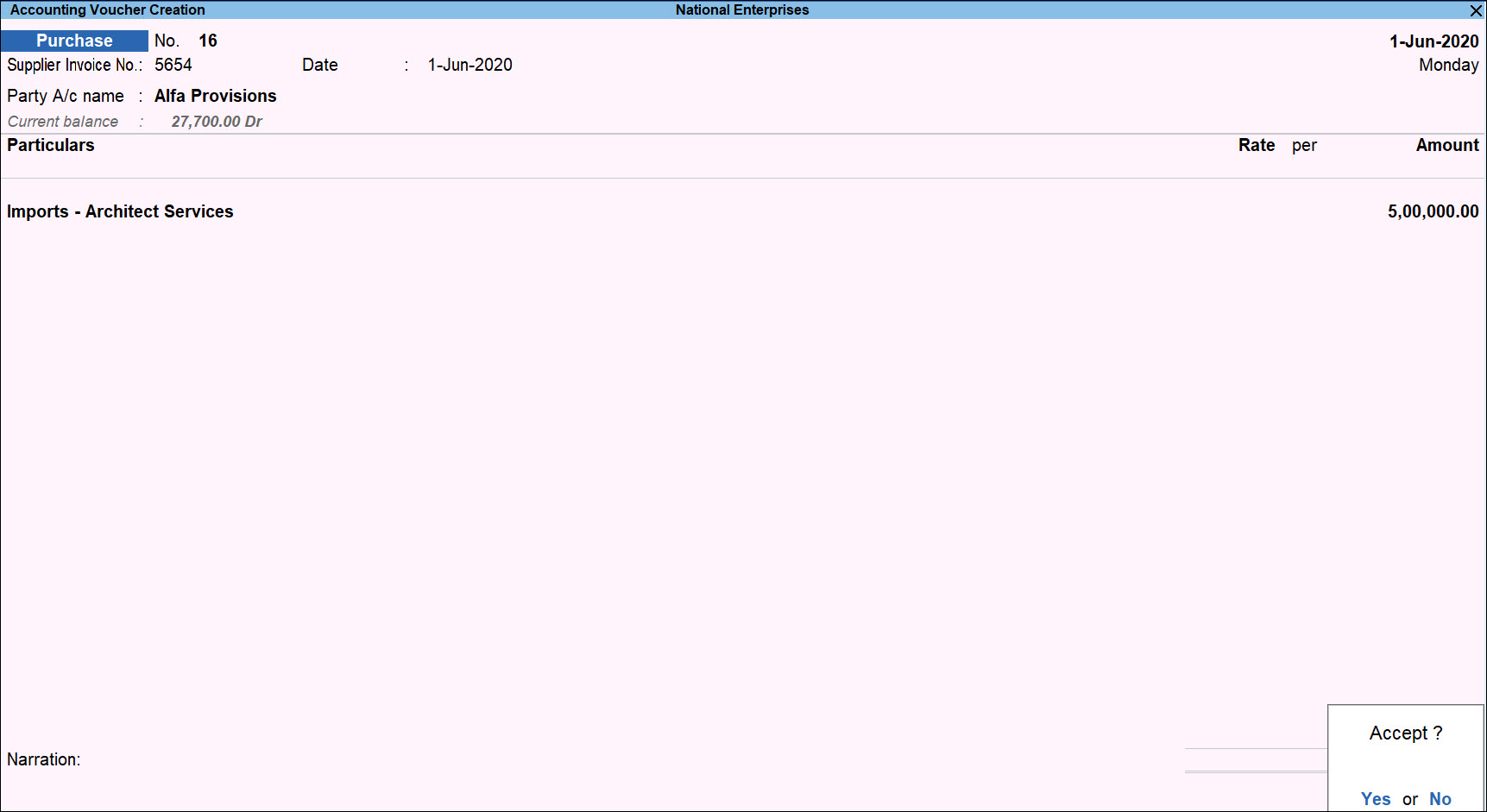

For example, on 23-4-2015, ABC Company imported architect services for ₹ 5,00,000 from In Color Architects. ABC company is liable to pay service tax on imported service.

- Gateway of Tally > Vouchers > press F9 (Purchase).

Alternatively, press Alt+G (Go To) > Create Voucher > press F9 (Purchase). - Press Ctrl+H (Change Mode) to select the required voucher mode (Accounting Invoice, in this case)

- Select In Color Architects in the field Party’s A/c Name.

- Select the purchase ledger under Particulars.

- Enter 5,00,000 in the field Amount.

- Press Enter to save.

- Enter Narration, if required.

- Accept the screen. As always, you can press Ctrl+A to save.

Since the entire service tax amount incurred will be the recipient’s liability, ABC Company will to pay the department. ABC Company can either raise the liability using a journal voucher or can directly make a payment to the department.